Reinstatement Cost Assessments

Accurate Reinstatement Cost Assessments to Ensure Proper Property Insurance Coverage

At INform Surveying, our team of chartered building surveyors specialise in providing accurate Reinstatement Cost Assessments (RCAs) to ensure that your property is adequately insured. Whether you own a commercial, industrial, or residential property, an RCA is essential for protecting your assets and safeguarding against under or over-insurance.

In this blog, we’ll explore the importance of Reinstatement Cost Assessments, how they help property owners avoid financial risks, and what should be included in a case study to showcase the impact of this service. With our expertise, we ensure that your property is insured with precision and foresight.

- Complementary services:

- + Building Survey

- + Measured Surveys

- + Dilapidations

- + Schedule of Condition

Key Considerations for Effective Reinstatement Cost Assessments

01 Accurate Property Assessments:

To ensure your property is adequately insured, we conduct a thorough analysis of its size, construction type, materials, and bespoke or site specific aspects. Our RCAs provide precise rebuild valuations, considering all aspects of the building’s structure, fixtures, and finishes and evaluating against current market conditions and cost indices.

02 Consideration of Demolition and Site Clearance Costs:

An often-overlooked aspect of reinstatement cost assessments is the inclusion of demolition and site clearance costs. These are critical elements that must be factored into the valuation to ensure that the full cost of rebuilding, from initial clearance to final construction, is covered.

03 Adjustment for Building Regulations:

Construction and Building Regulations evolve over time, often requiring more expensive materials or methods than when the property was originally built. Our RCAs ensure that any regulation updates are incorporated into the assessment, providing a valuation that reflects today’s requirements for a compliant rebuild.

04 Periodic Reviews and Updates:

Market conditions and construction costs change, so an RCA from several years ago may no longer be accurate. We recommend regularly reviewing your property’s reinstatement cost assessment to ensure the valuation remains current, assuring you that your insurance continues to provide full coverage.

05 Expert Analysis and Reporting:

Our team of chartered building surveyors provides detailed, clear reports that are easy for both clients and insurers to understand. We avoid technical jargon and focus on delivering transparent, actionable insights that help our clients make informed decisions about their insurance coverage.

WHY REINSTATEMENT COST ASSESSMENTS MATTER

A Reinstatement Cost Assessment calculates the cost of rebuilding your property from scratch in the event of total destruction, ensuring your insurance policy provides sufficient cover. Having an accurate RCA is crucial for several reasons:

Avoiding Underinsurance: If your property is insured for less than its reinstatement cost, you could face significant out-of-pocket expenses if you need to rebuild after a major loss. Underinsurance is a common issue and can result in financial hardship for property owners

Preventing Overinsurance: Conversely, insuring your property for more than its true reinstatement cost means you’re overpaying for coverage you don’t need. An RCA helps property owners avoid this unnecessary expense by providing a precise, up-to-date valuation.

Compliance with Insurance Policies: Many insurance providers require regular updates to reinstatement cost values. Having an accurate RCA ensures compliance and helps avoid disputes in the event of a claim.

At INform Surveying, we offer comprehensive Reinstatement Cost Assessments that consider the latest building regulations, material costs, and construction trends. Our team provides property owners with the peace of mind that comes from knowing their assets are fully protected.

Our founders are always available for advice or support—feel free to reach out directly.

To learn more about our journey and values, visit our About Us page. Together, we’ve built a consultancy dedicated to placing clients first, delivering not just solutions, but clarity, precision, and long-term success.

CASE STUDY: GLOBAL ASSET MANAGER

Introduction and Client Background

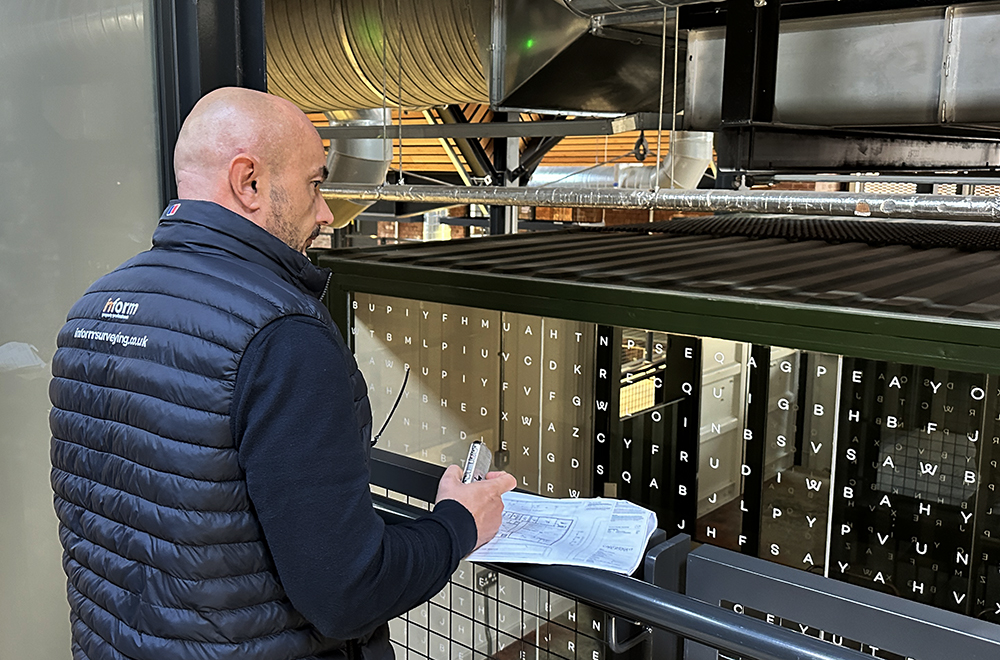

INform Surveying was instructed by a global asset manager to conduct reinstatement cost assessments on their industrial portfolio in the north of England. The purpose of this instruction was to provide accurate reinstatement valuations for insurance purposes.

Reassessments should typically occur every three years unless significant changes are made to an insured property, as building costs fluctuate, directly affecting insurance premiums.

Objectives of the Reinstatement Cost Assessment

The client had historical valuations for insurance cover, but these were outdated and undervalued due to fluctuations in construction costs over the past three years. INform Surveying was instructed to carry out new assessments rather than simply updating the existing values, as a desktop review would not provide the required level of accuracy. This ensured the client had accurate valuations, mitigating financial risks and ensuring the correct sums were insured.

Survey Methodology and Process

Inform Surveying conducted site inspections of all properties included within the instruction, gathering key data such as:

• Building and site areas

• Construction type and materials

• Special factors, such as neighbourly matters and deleterious materials

The inspections also provided an opportunity to identify tenant alterations or extensions, which could affect the rebuild valuation. Obtaining site-specific information is critical for delivering a detailed and reliable reinstatement cost assessment.

After our inspections, it became clear that the current reinstatement cost values were insufficient. Several alterations had been made to the properties, resulting in an increased rebuild value. However, not all alterations affect Landlord insurance, requiring thorough lease reviews to establish responsibility.

As our valuations were higher than the existing insurance cover, the client’s tenants faced increased insurance premiums. This often creates potential conflicts, as service charges need adjustment. The detailed and precise reinstatement cost assessments produced by INform Surveying provided clear justification for the increase, relieving pressure on the client and eliminating potential disputes.

The client was very satisfied with INform Surveying’s service and subsequently instructed us to carry out additional reinstatement cost assessments on their other property portfolios. The Landlord now has peace of mind, knowing that their properties are accurately valued and fully insured.

CONTACT US

If you’d like to arrange a meeting or learn more about what we do, please email us or give us a call.

'Inform Surveying is committed to achieving net zero carbon emissions across our operations and value chain, covering Scopes 1, 2, and 3 emissions in line with the Greenhouse Gas Protocol. This includes direct emissions from company-owned vehicles and on-site fuel use (Scope 1), indirect emissions from purchased energy such as electricity and heating (Scope 2), and other indirect emissions across our value chain, including business travel, procurement, and waste (Scope 3).

We have set a target to reach net zero by 2050, with interim milestones to reduce carbon intensity across all scopes. Our approach includes implementing energy efficiency measures, transitioning to renewable energy, reducing business travel, and engaging suppliers and partners to adopt sustainable practices.

While Inform Surveying does not yet have targets formally validated by the Science Based Targets initiative (SBTi), we are committed to aligning our strategy with science-based principles and plan to seek SBTi validation as our carbon reduction program develops.'

CONTACT INFORMATION

Our Office

102-103 Hague, Park Hill,

South Street, Sheffield S2 5AS

What 3 words: placed.backed.agenda

Open Office Hours

Mon-Fri : 9:00am - 5:30pm

Get in Touch

+44(0)114 321 9919